All Categories

Featured

Table of Contents

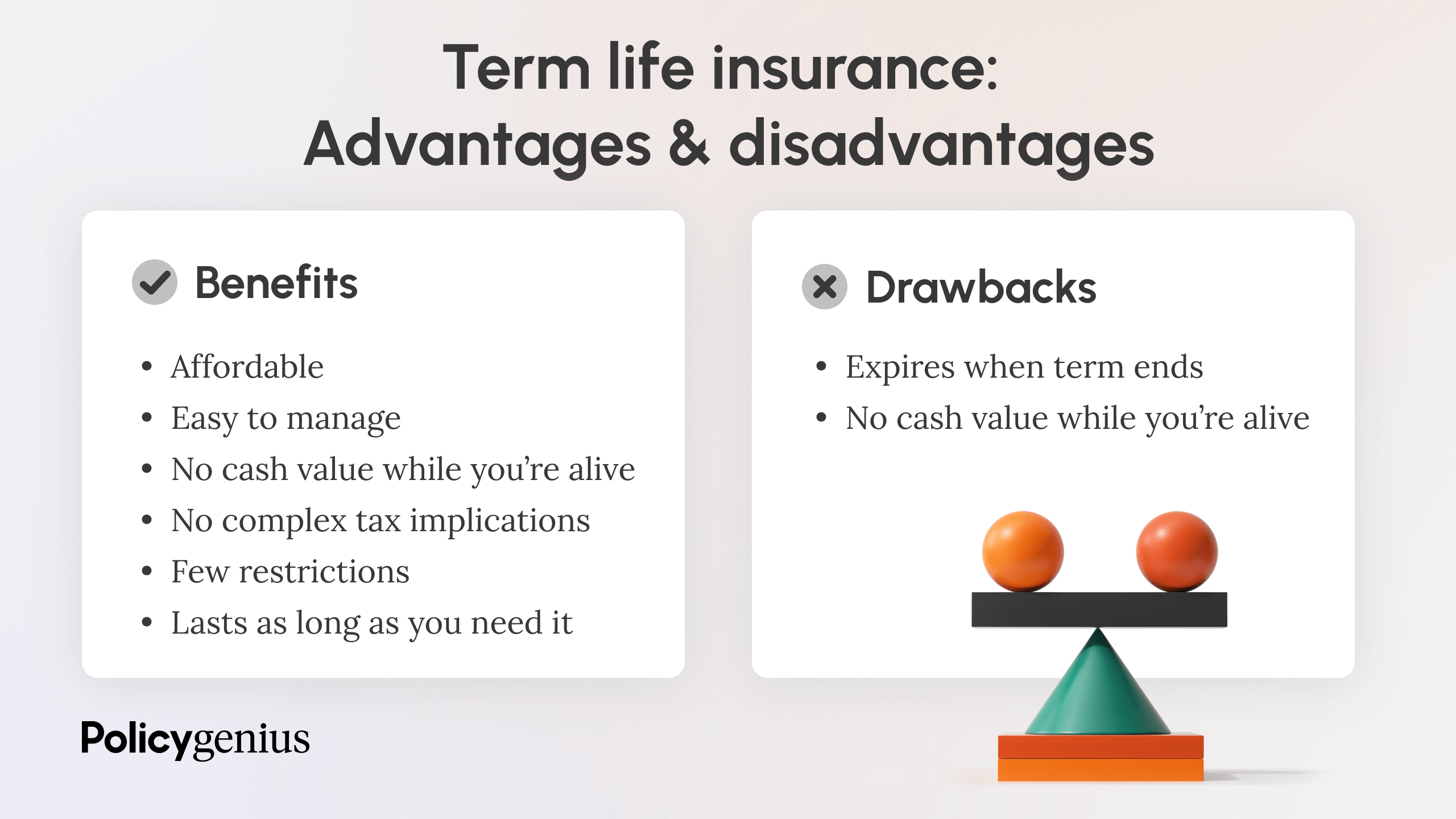

There is no payment if the plan expires before your fatality or you live past the policy term. You might be able to renew a term plan at expiration, but the premiums will be recalculated based upon your age at the time of renewal. Term life insurance is normally the least expensive life insurance policy readily available due to the fact that it provides a survivor benefit for a limited time and doesn't have a money value element like irreversible insurance.

At age 50, the costs would increase to $67 a month. Term Life Insurance coverage Rates 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life policy, for males and females in excellent health. In comparison, here's a consider rates for a $100,000 entire life plan (which is a kind of irreversible plan, suggesting it lasts your lifetime and consists of cash value).

Which Of The Following Statements Regarding Term Life Insurance Is Incorrect?

The reduced risk is one factor that permits insurance companies to bill lower premiums. Rates of interest, the financials of the insurance business, and state guidelines can likewise affect premiums. As a whole, firms often use far better prices at the "breakpoint" coverage levels of $100,000, $250,000, $500,000, and $1,000,000. When you consider the amount of insurance coverage you can obtain for your premium dollars, term life insurance policy often tends to be the least costly life insurance policy.

He acquires a 10-year, $500,000 term life insurance coverage policy with a premium of $50 per month. If George passes away within the 10-year term, the policy will pay George's recipient $500,000.

If George is identified with a terminal health problem throughout the first policy term, he probably will not be eligible to renew the policy when it ends. Some plans use assured re-insurability (without proof of insurability), but such features come with a higher cost. There are numerous sorts of term life insurance.

Many term life insurance has a degree premium, and it's the type we've been referring to in most of this write-up.

Best Term Life Insurance For Diabetics

Term life insurance is eye-catching to youths with children. Parents can obtain considerable insurance coverage for an affordable, and if the insured dies while the plan holds, the family can count on the fatality advantage to change lost revenue. These policies are also fit for people with expanding family members.

The ideal choice for you will rely on your requirements. Below are some points to think about. Term life policies are perfect for people that desire considerable protection at an inexpensive. Individuals that own entire life insurance policy pay extra in premiums for less coverage however have the safety of recognizing they are shielded permanently.

The conversion biker ought to enable you to convert to any long-term plan the insurance coverage company supplies without restrictions - term life insurance for couples. The main functions of the cyclist are keeping the initial health score of the term policy upon conversion (even if you later have wellness concerns or come to be uninsurable) and deciding when and how much of the coverage to convert

Certainly, total premiums will enhance substantially since whole life insurance policy is a lot more pricey than term life insurance policy. The benefit is the guaranteed authorization without a medical examination. Medical problems that establish during the term life period can not create premiums to be increased. The firm may call for minimal or complete underwriting if you want to add added motorcyclists to the brand-new policy, such as a long-lasting care cyclist.

Entire life insurance policy comes with significantly greater monthly costs. It is meant to supply protection for as lengthy as you live.

Level Premium Term Life Insurance Policies

Insurance policy firms set a maximum age limit for term life insurance policies. The costs additionally rises with age, so a person aged 60 or 70 will pay significantly more than someone decades more youthful.

Term life is rather comparable to car insurance. It's statistically unlikely that you'll require it, and the premiums are money down the tubes if you don't. If the worst happens, your family will get the benefits.

This plan style is for the consumer that requires life insurance policy however wish to have the ability to choose how their cash money value is spent. Variable plans are underwritten by National Life and dispersed by Equity Providers, Inc., Registered Broker/Dealer Affiliate of National Life Insurance Policy Company, One National Life Drive, Montpelier, Vermont 05604.

For J.D. Power 2024 award information, check out Permanent life insurance policy establishes money value that can be obtained. Plan lendings build up interest and overdue plan car loans and interest will lower the death advantage and money value of the policy. The quantity of cash money value readily available will generally rely on the sort of long-term plan acquired, the amount of insurance coverage purchased, the size of time the plan has been in force and any kind of impressive policy lendings.

After The Extended Term Life Nonforfeiture Option Is Chosen The Available Insurance Will Be

A complete statement of insurance coverage is discovered only in the policy. Insurance plans and/or linked cyclists and features might not be offered in all states, and policy terms and problems may vary by state.

The main distinctions between the different kinds of term life plans on the marketplace have to do with the size of the term and the coverage amount they offer.Level term life insurance policy features both level premiums and a level survivor benefit, which indicates they stay the same throughout the duration of the policy.

, likewise known as an incremental term life insurance coverage strategy, is a plan that comes with a fatality benefit that enhances over time. Common life insurance coverage term lengths Term life insurance coverage is budget-friendly.

The major distinctions in between term life and whole life are: The size of your coverage: Term life lasts for a collection period of time and then expires. Average monthly whole life insurance policy price is determined for non-smokers in a Preferred health category, getting an entire life insurance plan paid up at age 100 used by Policygenius from MassMutual. Aflac supplies numerous long-term life insurance policies, including whole life insurance, final expense insurance policy, and term life insurance.

Latest Posts

Lenders That Accept Term Life Insurance As Collateral

Life Insurance Short Term

Extending Term Life Insurance